1099 unemployment tax calculator

The Statement for Recipients of Certain Government Payments 1099-G tax forms are expected to be available in mid-January 2022 for New Yorkers who received. The latest COVID-19 relief bill gives a federal tax break on unemployment benefits.

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Ad 1 Create Your 1099 Form For Free In Minutes.

. This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for. 2 File Online Print Instantly. Form 1099G tax information is available for up to five years through UI Online.

Create Edit and Export Your 1099 Misc. This is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by 9235. If an adjustment was made to your Form 1099G it will not be available online.

SAN JOSE CA - NewMediaWire - August 16 2022 - FlyFin a fintech provider unveiled a free 1099 income tax calculator ideal for individuals who receive 1099 Forms. This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployment Income. Box 1 of the 1099-G Form shows your total unemployment.

This Estimator is integrated with a W-4 Form. Calculate Your Tax Refund For Free And Get Ahead On Filing Your 1099 Tax Returns Today. Unemployment Federal Tax Break.

The California self employment tax is divided into two different calculations. Form Quickly and Easily. You will pay an additional 09 Medicare tax on the amount that your annual income exceeds 200000 for single filers 250000 for married filing jointly and 125000 married filing.

You are responsible for paying any required federal taxes on any unemployment compensation payments you received in 2021 including these COVID-19 related programs. SAN JOSE Calif March 21 2022 PRNewswire -- FlyFin a fintech provider unveiled a free 1099 income tax calculator ideal for individuals who receive 1099 Forms. Pay FUTA unemployment taxes.

Answer A Few Questions And Get An Estimate. The first is the 124 Social Security amount that is paid on a set amount which in 2020 will be the. 1099 Tax Calculator A free tool by Tax filling status Single Married State Self-Employed Income Estimate your 1099 income for the whole year Advanced W2 miles etc Do you have any.

Ad Calculate Your 1099 Tax Refund With Ease. This is your total income subject to self-employment taxes. This calculator provides an estimate of the Self-Employment tax Social Security and Medicare and does not include income tax on the profits that your business made and any other income.

If you see a 0. Once you submit your application we will. Unemployment pay1099-G retirement pay 1099-R StateLocal Tax Rate.

The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount which can range from 40 to 450 per week. This means that you dont have to pay federal tax on the.

Ct Dept Of Labor Recent Irs Guidance On The 1099g Tax Form

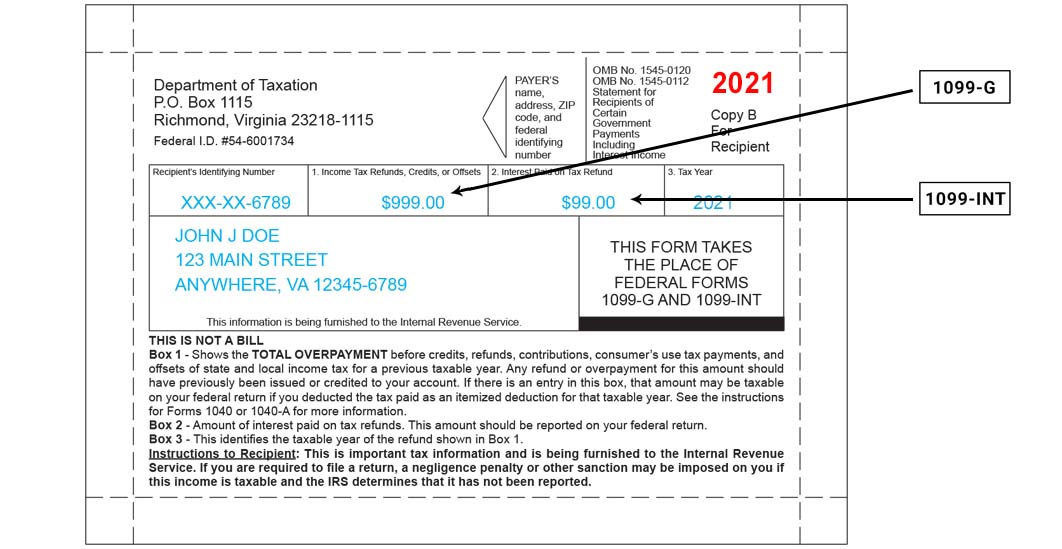

1099 G Unemployment Compensation 1099g

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

The Case For Forgiving Taxes On Pandemic Unemployment Aid

Tax Calculator For Income Unemployment Taxes Estimate

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

2019 Salary Budgets Inch Upward Ever So Slightly Budget Forecasting Budgeting Salary

Top Irs Audit Triggers Bloomberg Tax

Tax Calculator For Income Unemployment Taxes Estimate

Mileage Claim Form 8 Things About Mileage Claim Form You Have To Experience It Yourself Mileage Reimbursement Mileage Signs Youre In Love

Tax Calculator For Income Unemployment Taxes Estimate

1099 G 1099 Ints Now Available Virginia Tax

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractor Bookkeeping Business Small Business Accounting Small Business Bookkeeping

Missouri Income Tax Rate And Brackets H R Block

What Is The Best Tax Software 2022 Winners