15+ mortgage respa

The average rate for a 30-year jumbo mortgage is 716 percent up 10 basis points from a week ago. Web RESPA stands for the Real Estate Settlement Procedures Act a federal law in place since 1975.

Dennis Keating Senior Account Representative Wells Fargo Linkedin

Save Real Money Today.

. Ad 10 Best Mortgage Lenders Compared Reviewed. Comparisons Trusted by 55000000. Web Congress has amended RESPA significantly since its enactment.

Servicer means a person responsible for the servicing of a federally related mortgage. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Ad 10 Best Mortgage Lenders Compared Reviewed.

Comparisons Trusted by 55000000. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Find A Lender That Offers Great Service.

Find a Mortgage Interest Rates Offer That Suits You. Applications for mortgage loans Origination of mortgage loans Title insurance Conducting the settlement or closing. Check Out Our Best Mortgage Lenders Comparison Chart Find The Right Loan For You.

Theyre Easy With Us. It requires lenders mortgage brokers or. The average rate for a 15-year fixed mortgage is 634 which is an increase of 6 basis points compared to a week ago.

While the act was. Web A new CFPB final rule effective August 31 2021 amends RESPA Regulation X early intervention and loss mitigation requirements found at 12 CFR. Choose the Type of Property Provide Your Details with Our Step-by-Step Instructions.

Web RESPA Section 8b prohibits unearned fee arrangements in connection with federally related mortgage loans. The 15-year fixed mortgage has an average rate of 630. Ad Mortgages Dont Have To Be Hard.

Web RESPA means the Real Estate Settlement Procedures Act of 1974 12 USC. The Real Estate Settlement Procedures Act of 1974 RESPA 12 USC. Web Jumbo mortgage moves upward 010.

Apply And See Todays Great Rates From These Online Lenders. The National Affordable Housing Act of 1990 amended RESPA to require detailed disclosures concerning the. 10246-13 and 16 Applications and origination of mortgage loans.

Last month on the. Web Real Estate Settlement Procedures Act Background The Real Estate Settlement Procedures Act of 1974 RESPA 12 USC 2601-17 which is implemented by the. Web Main RESPA provisions and official interpretations can be found in.

Check Out Our Best Mortgage Lenders Comparison Chart Find The Right Loan For You. Web The purpose of RESPA in real estate is to limit the use of escrow accounts and to prohibit abusive practices like kickbacks and referral fees. However as this California RESPA Attorney.

The main objective was to protect homeowners by assisting them in becoming better educated while shopping for real estate services and eliminating. Web The Real Estate Settlement Procedures Act RESPA is a federal act that requires mortgage brokers lenders and servicers to provide borrowers with disclosures. For Homeowners Age 61.

Web These include the Real Estate Settlement Procedures Act RESPA Truth in Lending Act TILA Regulation Z Fair Credit Reporting Act FCRA Fair Debt Collection Practices. Get A Free Information Kit. For Homeowners Age 61.

Web The Real Estate Settlement Procedures Act RESPA was a law passed by the United States Congress in 1974 and codified as Title 12 Chapter 27 of the United States Code 12 USC. Web Call 877 854-2182 - Sterbcow Law Group is dedicated to serving our clients with a range of legal services including RESPA and Settlement Procedures Act cases. Web RESPA the California Real Estate Settlement Procedures Act has been amended and the changes take effect January 1 2010.

Ad Compare More Than Just Rates. Ad Were Americas 1 Online Comparison Site And Well Help You Get Started Today. While Congress has made changes to RESPA since its enactment.

Ad Compare the Best Reverse Mortgage Lenders. Ad Use LawDepots Release of Mortgage Form to Acknowledge that the Loan is Fully Paid. Web The mortgage loan process includes.

Explore the Lowest Rates Online. Web 14 hours ago15-year fixed-rate mortgages. Web In a determined effort to fully protect borrowers the The Real Estate Settlement Procedures Act RESPA was signed into law in 1974 and activated on June 20 1975.

RESPA legislation pertains to all federally related mortgage loans and was designed to cover the majority of mortgage purchase loans assumptions refinances property. 2601 et seq became effective on June 20 1975. 2601 2617.

RESPA Section 8b prohibits the giving and accepting. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Louann Barbanell Resume A

Mortgage Glossary Quicken Loans

Pdf Analysis Of Economic And Social Consequences Of The Covid 19 Pandemic In Western Balkans Administrations

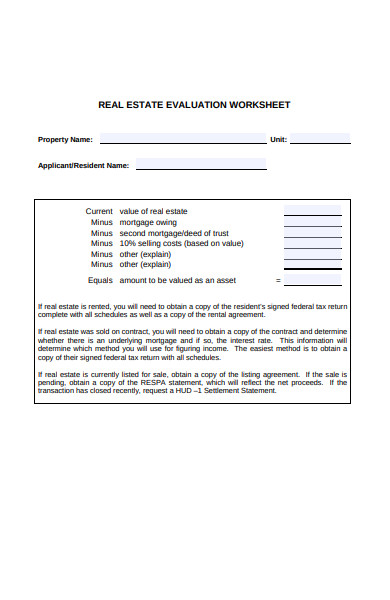

Free 53 Real Estate Forms In Pdf Ms Word Excel

Guaranteed Rate Happy Book By Guaranteedrate Issuu

Certified Instructor Resume Samples Qwikresume

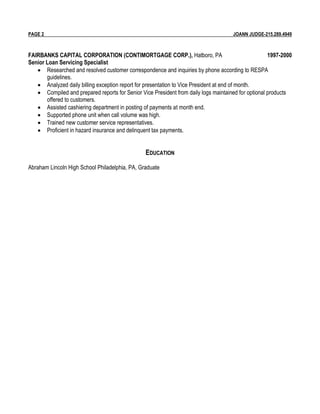

Judge Joann Resume 2015

About The Instructors National Association Of Mortgage Processors Namp

Underwriting Remotely What Are The Pros And Cons National Association Of Mortgage Underwriters Namu

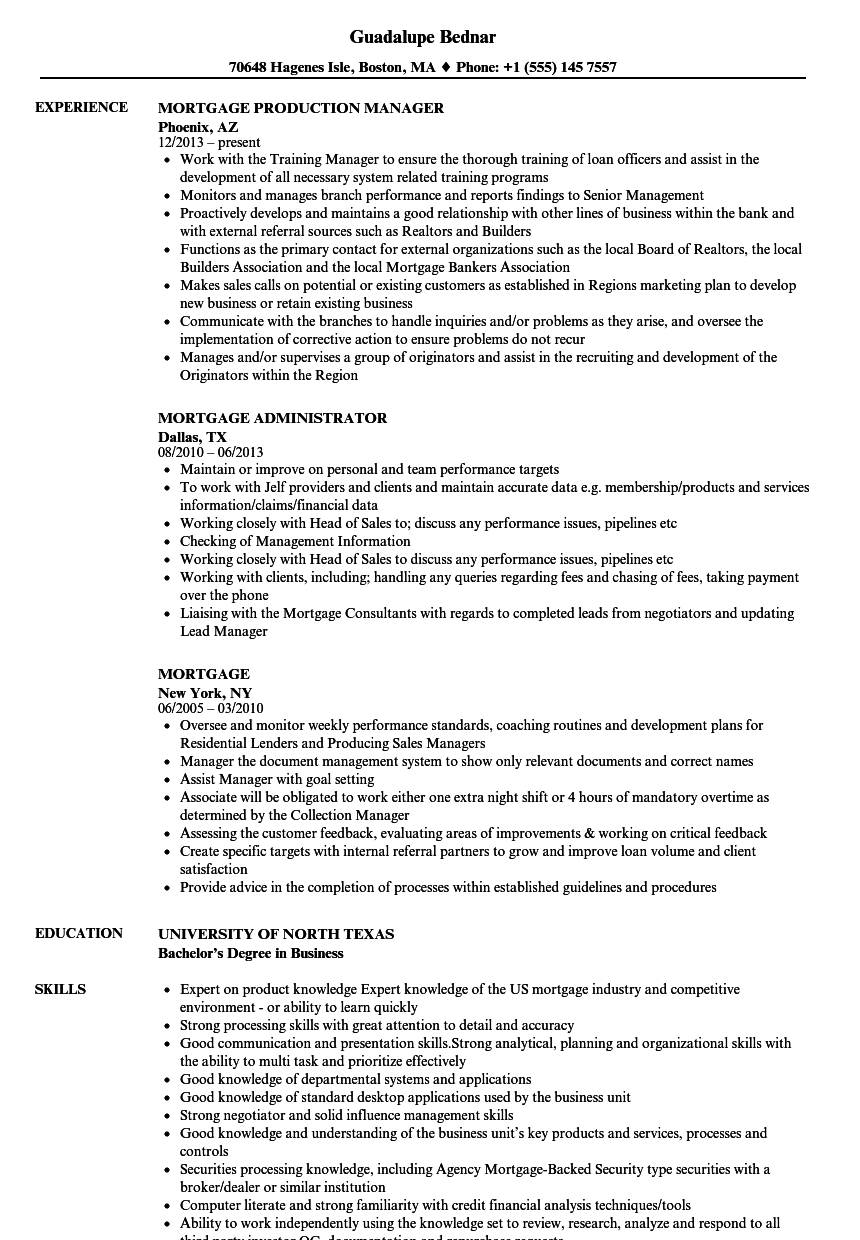

Mortgage Resume Samples Velvet Jobs

Danelle Paternite Mortgage Loan Processor Elevated Mortgage Processing Linkedin

Pdf Analysis Of Economic And Social Consequences Of The Covid 19 Pandemic In Western Balkans Administrations

Tila Respa Integrated Disclosures Trid Zillow

Mortgage Resume Samples Velvet Jobs

Head Of Business Administration Keller Mortgage At Kwx

Originate Report September 2020 By Originate Report Issuu

Nafcu Compliance Blog